How SIP Investment Works: A Smart Way to Grow Wealth

SIP investment kya hai aur kaise kaam karta hai? Jaane SIP ke benefits, compounding ka magic aur step-by-step SIP invest ka tarika in Hindi.

“Thoda-thoda invest karo, bada paisa banao.”

ab aaiye samjte hai Aaj ke zamane mein log mutual funds ke zariye paisa banane lage hai, aur SIP yani (Systematic Investment Plan) unme se sabse popular aur smart tareeka hai.

Agar aap confused ho ki what is SIP and how it works, to yeh blog aapke liye hai. Yaha hum simple Hindi mein samjhayenge:

- SIP kya hota hai

- Kaise kaam karta hai (with example)

- Compounding ka magic kya hai

- Kaise shuru karein (step-by-step)

SIP Investment Kya Hai? (What is SIP and How it Works)

SIP ka full form hai: Systematic Investment Plan.

Ye ek aisa method hai jisme aap har mahine thoda-thoda paisa invest karte ho kisi mutual fund mein – jaise ₹500, ₹1000, ₹2000 ya jitna aap afford kar sakte ho.

Simple words mein:

SIP ek EMI jaise hoti hai – bas ye loan chukane ke liye nahi, paisa banane ke liye hoti hai.

Key Features of sip investment:

- Regular investment (monthly/quarterly)

- Starts from ₹500

- Auto-debit option from your bank

- Long-term growth through share market returns

- Ideal for salaried & beginners

SIP Kaise Kaam Karta Hai? – How SIP Works with Example

Let’s simplify with a real-world example:

Example:

Rahul har mahine ₹2000 invest karta hai ek SIP mutual fund mein, 12% annual return ke saath.

| Year | Yearly Investment | Total Investment | Approx. Value @12% |

| 1 | ₹24,000 | ₹24,000 | ₹25,560 |

| 5 | ₹1,20,000 | ₹1,20,000 | ₹1,60,755 |

| 10 | ₹2,40,000 | ₹2,40,000 | ₹4,00,187 |

| 20 | ₹4,80,000 | ₹4,80,000 | ₹19,84,000+ |

Bottom line: SIP se paisa slow aur steady grow karta hai – “boond-boond se sagar”

SIP Aur Compounding – How SIP Compounding Works

Compounding SIP ka sabse powerful weapon hai. Isme aap jo paise kamate ho, uspe bhi agle mahine interest milta hai.

Compounding ka formula:

A = P × (1 + r/n) ^ nt

Yahaan A = Final Amount, P = Principal, r = rate, t = time

you don’t need math. Bas ye samajhiye

- 1st year mein ₹10,000 ne 10% return diya → ₹11,000

- 2nd year mein pura ₹11,000 par return milega → ₹12,100

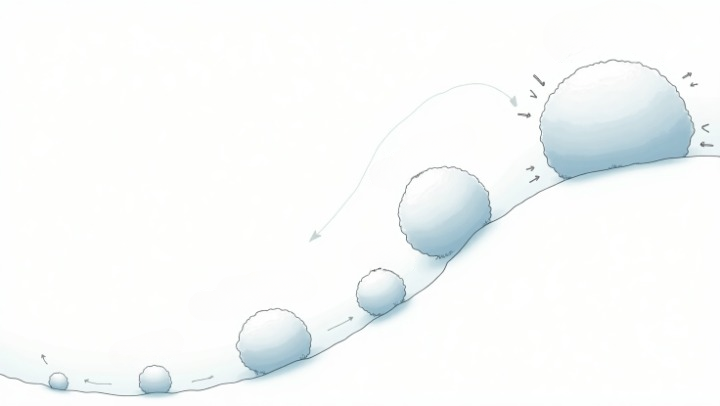

Yeh snowball effect banata hai – jise jitna lamba time milega, utna jyada power dikhega.

SIP vs One-Time Investment

| Feature | SIP | One-Time Investment |

| Investment Type | Regular (monthly) | Ek baar mein poora paisa |

| Risk | Low (market average) | High (market timing matter karta hai) |

| Flexibility | High | Low |

| Compounding | Better long-term | Depends on timing |

| Ideal For | Beginners, salaried | Lump sum investors |

Conclusion: SIP zyada consistent hota hai. Market ke highs-lows ko average kar deta hai (rupee cost averaging).

SIP Kaise Start Kare?

Step-by-Step Guide:

1. Goal Decide Kare

- Retirement

- Child’s education

- House down payment

2. Risk Level Samjhein

- Low Risk → Debt SIPs

- Medium Risk → Hybrid SIPs

- High Risk → Equity SIPs

3. Right Mutual Fund Chune

Use trusted apps/websites:

Groww, Zerodha Coin, upstox

4. KYC Complete Kare

Aadhar, PAN card, Bank details ready rakhe

5. Auto-Debit Set Kare

Monthly amount fix kare (₹500 se start)

SIP FAQs (Frequently Asked Questions)

❓ 1. SIP safe hai ya nahi?

✅ Yes. SIP mutual funds SEBI-regulated hote hain. Long-term mein risk kam hota hai.

❓ 2. Har mahine paisa nahi mila to kya?

SIP skip ho sakta hai, lekin fund mein paise bane rahenge. Late fees nahi lagti.

❓ 3. Kya SIP se crore ban sakta hai?

Yes – ₹5000/month for 25 years @12% → ₹1.5 crore+ (compounding ka jadoo!)

❓ 4. SIP mein kab invest kare?

SIP ka beauty hai ki timing matter nahi karta – aap regular invest karte ho.

isual Suggestion: SIP Growth Timeline Chart

Design a horizontal bar:

- ₹1000/month → ₹17 lakh in 25 years @12%

- ₹2000/month → ₹34 lakh

- ₹5000/month → ₹86 lakh+

Yeh chart show karega growth over time for same rate with different SIPs.

Expert Tips for SIP Success

- SIP ko long-term commitment samjho (5+ years)

- Market down ho to ghabrao nahi – yeh buying opportunity hoti hai

- SIP increase karo jab salary badhe

- SIP holiday ka option hota hai, lekin ise avoid karna chahiye jab tak zaroori na ho.

Conclusion: SIP – Smart India Plan

SIP ek financial discipline hai. Itna simple hai ki student bhi shuru kar sakta hai aur itna powerful hai ki retirement secure kar sakta hai.

“Early start + regular investment + patience = Financial freedom.”

Agar aap confused ho ki investment shuru kaise karein, toh SIP is the best first step. Try karo, aur financial journey ka hero bano!

Kya aapne apni pehli SIP start ki hai?

💬 Comment mein bataye ya humse pooche – aapke liye best SIP kaun sa ho sakta hai.

📢 Is article ko share karein apne doston aur parivaar ke saath – taaki sab milke financially smart ban sakein.